who pays sales tax when selling a car privately in ny

Easy Online Legal Documents Customized by You. Once the buyer has the vehicle registered under his name he must pay to sell Texas.

All About New York Bills Of Sale Forms You Need Facts To Know

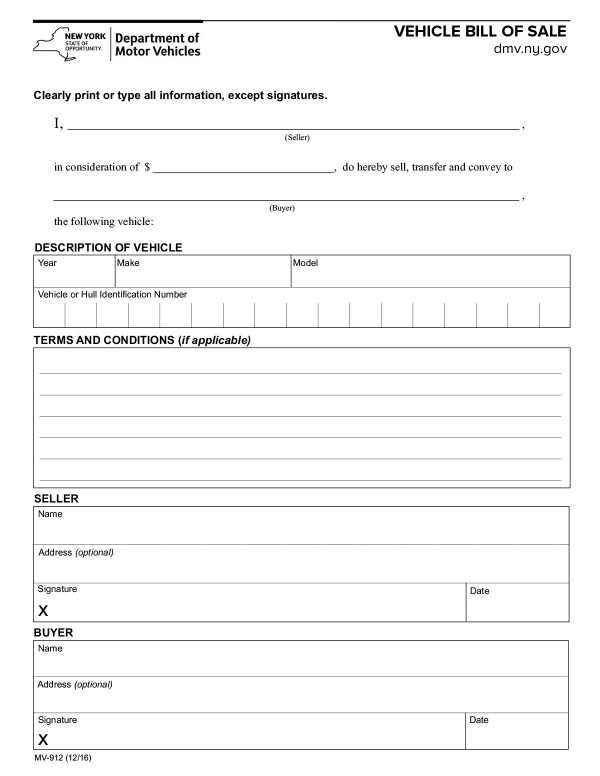

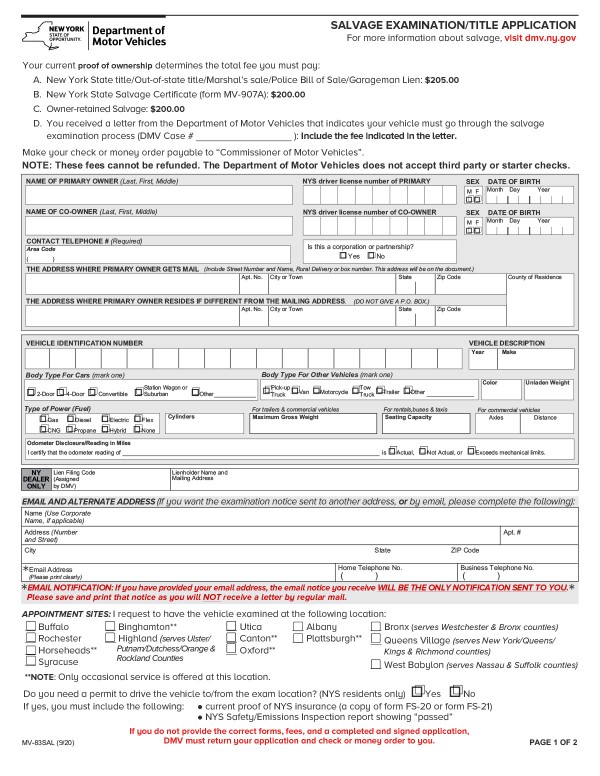

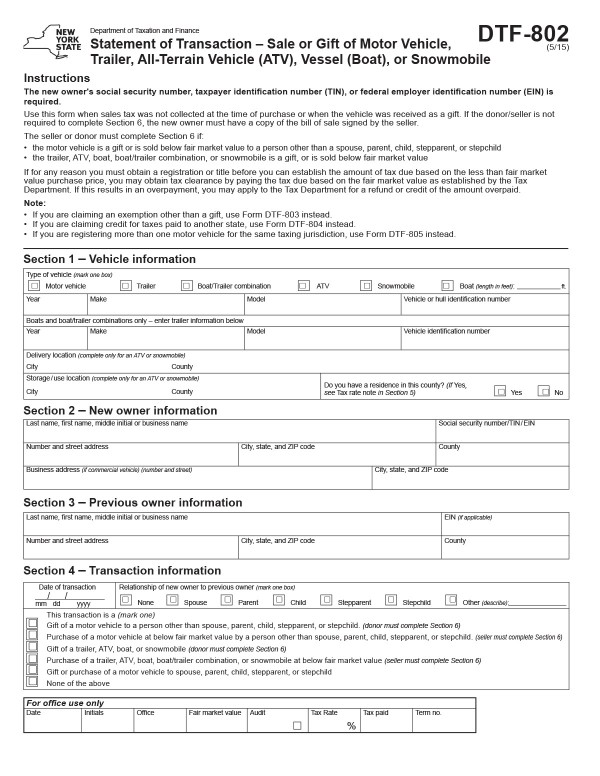

When a vehicle is sold in a private sale both the buyer and the seller must fill out a Statement of Transaction form DTF-802 which is then submitted to the New York DMV where the sales tax is calculated and collected from the buyer.

. As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door neighbor Massachusetts has a state car tax rate of 625 percent with some local rates much higher. You have to pay a use tax when you purchase a car in a private sale. However if you bought it for 14000 and sold it for 15000 earning a 1000 capital gain you would report this on your tax return using Schedule D on Form 1040 thats appropriately titled.

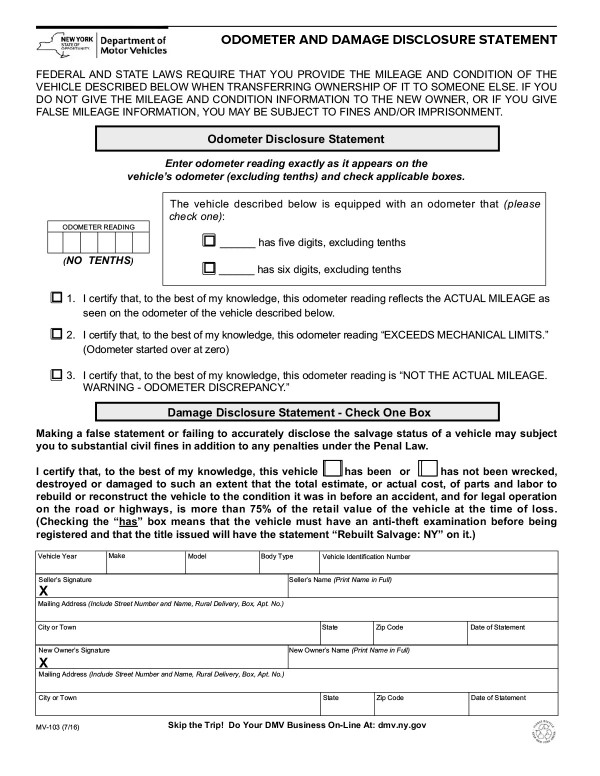

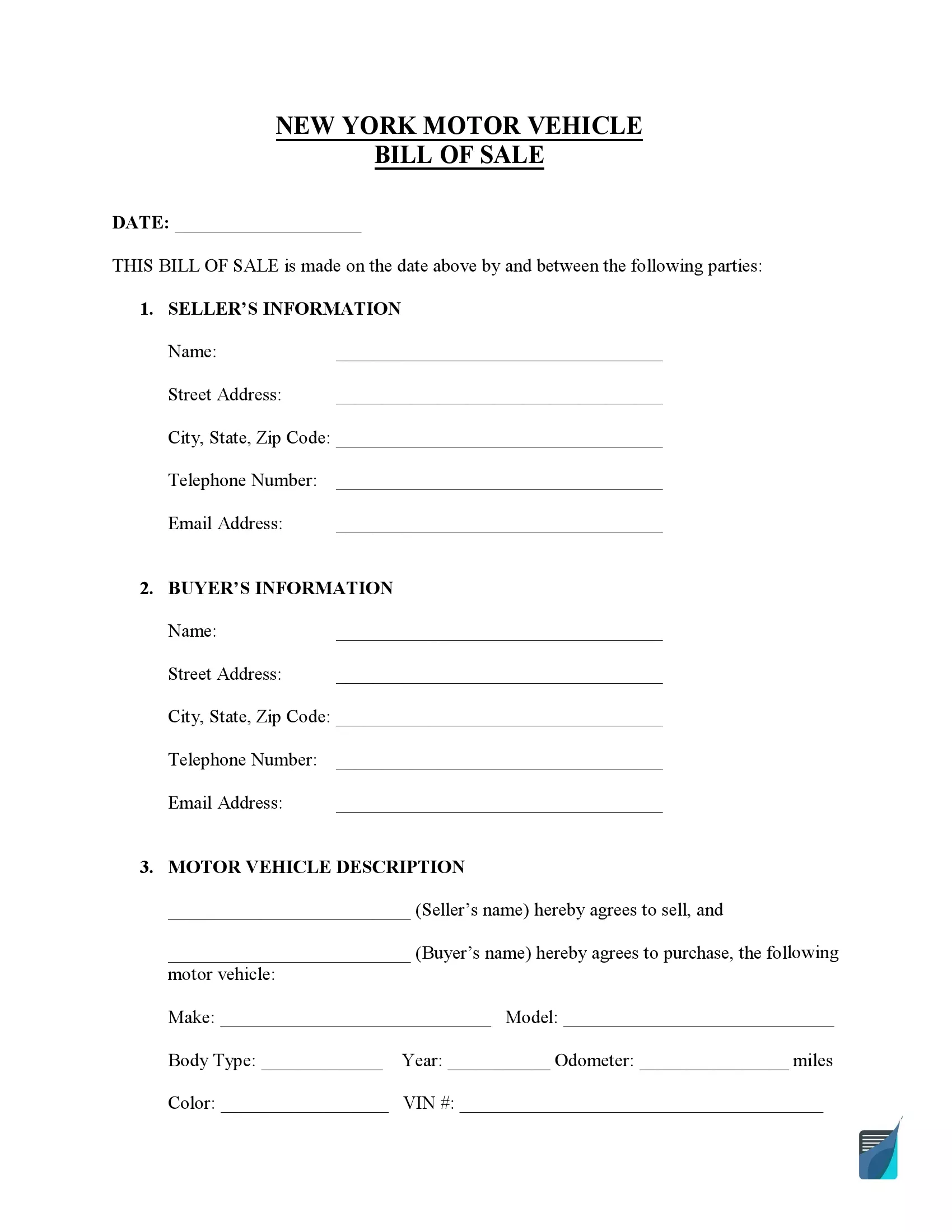

Odometer and damage disclosure statement if not on the back of the title use the Odometer and Damage Disclosure Statement Form MV-103. Sales tax is imposed on the services of parking garaging or storing motor vehicles in a garage parking lot or other place of business that provides these services but not if the garage is part of a private one-or two. So if you bought the car for 14000 and sold it for 8000 you would have a capitol loss of 6000.

Provide other acceptable proofs of ownership and transfer of ownership. When a dealer sells a motor vehicle to a resident of New York State the dealer must collect sales tax from the customer unless the sale is exempt. June 20 2014 Introduction.

Calculating New York auto sales tax can be tricky. Gift or selling a car in New York is broken down in this article. But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit.

For example Idaho charges a 6 tax which means you multiply the cost of the car 37851 and multiply it by 006. New York collects a 4 state sales tax rate on the purchase of all vehicles. It ends with 25 for vehicles at least 11 years old.

Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in. You would not have to report this to the IRS. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

If you purchase a vehicle from a dealership and there are manufacturer incentives and rebates associated the auto tax you will pay is determined by the sale price before the reduction. Yes you must pay sales tax when you buy a used car if you live in a state that has sales tax. To apply see Tax Bulletin How to Register for New York State Sales Tax TB-ST-360.

Ad Print or Download Your Customized Selling A Vehicle Privately in 5-10 Minutes for Free. If i sell my car do i pay taxes. Work From Home Jobs In Ny Data Entry Home Business Ideas For Nurses Home Work From Home Jobs Home Jobs Working From Home Share this post.

In addition to taxes car purchases in New York may be subject to other fees like registration title and plate fees. So that means if you buy a used vehicle in the area you will pay a total of eight percent in sales tax. Complete and sign the transfer ownership section of the title certificate and.

This important information is crucial when youre selling. Ad Free Fill-in Legal Templates. Once the lienholder reports to flhsmv that the lien has been satisfied.

Print or Download Your Customized Bill of Sale in 5-10 Minutes. You would just need to multiply the sale price of the car by the rate given for your New York home address. After the title is transferred the seller must remove the license plate from the vehicle.

Newer Post Older Post Home. Download Your Selling Your Car Privately Now. Instead the buyer is responsible for paying any sale taxes.

Determining how much sales tax you need to pay depends on your home states laws and the state in which you bought the car. LOOKING TO SELL YOUR VEHICLE. Sign the bill of sale even if it is a gift pay sales tax or have proof of an exemption.

Register and title the vehicle or trailer. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. Register and title the vehicle or trailer or snowmobile boat moped or atv or transfer a registration from another vehicle.

The seller must indicate the mileage of the vehicle in the appropriate spaces provided on the ownership document. That means Idaho charges a sales. Box 68597 Harrisburg PA 17106-8597.

In New York even if the vehicle is owned by two owners only one of the owners is required to sign the title in order to transfer ownership. NB NY DMV My neighbor sold me his old car a 97 maxima for 100000 the kbb value on the car is approx. Publication 838 1212 Penalties for operating without a valid Certificate of.

Im in the process of filling out the DMV forms and I noticed that he has to fill out a form that states that he sold it. The buyer will have to pay the sales tax when they get the car registered under their name. Sign a bill of sale even if it is a gift or.

Do not let a buyer tell you that you are supposed to pay the sales tax. In addition to taxes car purchases in New York may be subject to other fees like registration title and plate fees. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. If youre the buyer youll need to get the following from the seller. Who pays sales tax when selling a car privately in ny Wednesday February 16 2022 Edit.

The tax due in is called use tax rather than sales tax but the tax rate is the same. Check out the facts with IMPROV. The license plate should be returned to PennDOT at Bureau of Motor Vehicles Return Tag Unit PO.

You can find these fees further down on. For example Pleasantville New York currently has the lowest local sales tax rate of four percent. To transfer ownership of an original New York State Certificate of Title the buyer must fill out the and sign the transfer section of the proof of ownership.

On the other hand if you were to buy the exact used car in New York City you should prepare to pay up to 888 percent sales tax. All you need to know to sell or gift a car in NY. There are also a county or local taxes of up to 45.

In this case its 37851 x 006 227106. The DMV office collects the sales tax from the new owner if the new owner is required to pay any sales tax. Its relatively painless to complete the paperwork when buying or selling a car in a private nondealer transaction.

Start and Finish in Minutes. Parking Garaging and Storing Motor Vehicles Tax Bulletin ST-677 TB-ST-677 Printer-Friendly Version PDF Issue Date. 247 Support 800 660-8908.

You typically have to pay taxes on a car received as a gift in illinois.

Tips For Buying A Car In A Different State

New York Vehicle Sales Tax Fees Calculator

Free Vehicle Bill Of Sale Form For A Car Pdf Word Legal Templates

New York Dmv Chapter 3 Owning A Vehicle

Consider Selling Your Car Before Your Lease Ends Edmunds

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

All About New York Bills Of Sale Forms You Need Facts To Know

Nj Car Sales Tax Everything You Need To Know

New York Vehicle Sales Tax Fees Calculator

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

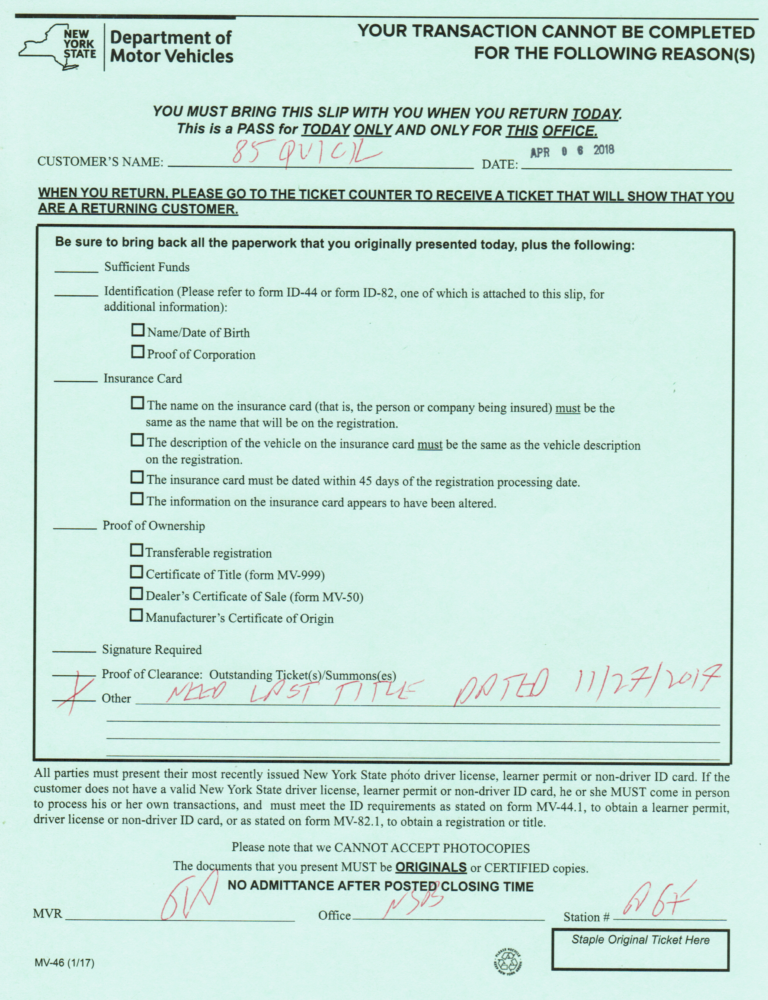

How To Buy A Car From A Private Seller In New York State 85quick Dmv Services

All About New York Bills Of Sale Forms You Need Facts To Know

New York Vehicle Sales Tax Fees Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Gifting A Car In Ny Transfer The Ownership Of Your Vehicle In Nys Selling A Car In Ny

Free New York Vehicle Bill Of Sale Form Pdf Formspal

What S The Car Sales Tax In Each State Find The Best Car Price

Title Transfer New York How To Transfer Vehicle Ownership In Ny Etags Vehicle Registration Title Services Driven By Technology

All About New York Bills Of Sale Forms You Need Facts To Know